A guide to surviving the storm of a recession

April 8, 2023

Recessionary or pre-recessionary periods can be extremely stressful times.

Broadly, recessions are periods of economic decline that affect the livelihood of people in the area in which the recession is occurring. During recessions, there is more unemployment, less economic output, and less personal consumption expenditures. “Bear markets” are generally defined as a time period when the stock market falls over 20% for a long period of time. They typically are accompanied by a recession.

It is vital that one follows researched rules and methods in order to come out of a recession feeling free. First, don’t panic! Short-term volatility is completely normal. The stock market is constantly changing. When one invests due to the stress of a recession, it can be labeled as “emotional investing,” a phenomenon in which someone invests based on movements of the market and their own feelings rather than quantitative analysis and research. When one sees the market dip, they may instinctively get scared and feel the urge to sell their assets.

Next, start investing more conservatively. Recessions are extremely volatile and come with large risks. For this reason, one likely shouldn’t make many risky investments during recessions. Researching stocks that are safer and proven to be recession-proof is extremely important to beating a recession. Consumer staple stocks, or stocks of companies that are valued as essentials for everyday life, are known to be some of the most recession-proof stocks. Some examples would be: Walmart, Proctor and Gamble, General Mills, and Nestle. These stocks are less likely to take a loss because they are going to sell products no matter what. Companies that are seen as more of a luxury are more likely to take a hit.

Next, start saving and spending more responsibly.

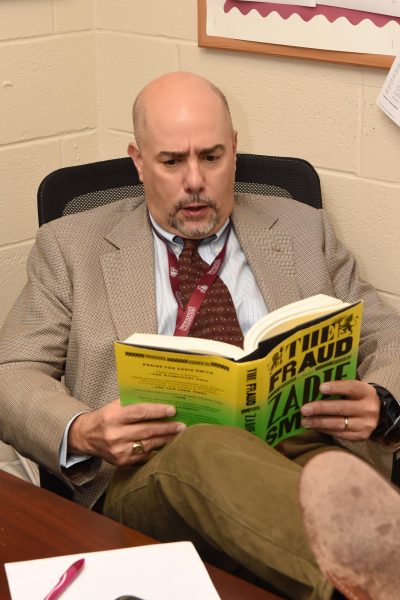

“The biggest thing is to really keep an eye on your spending and to make your savings much more purposeful,” said Wall Street teacher and personal finance club adviser Robert Plechner.

Noticing what one is spending and determining if it’s truly necessary is one of the first steps to improving financial security. Look out for savings rates as they generally go up as a result of a recession.

“Thankfully, what’s been bad for the economy in terms of the stock market with interest rates increasing is that savings rates have now become a little bit more reasonable, so good rates of returns are available on savings accounts. Students can normally get beneficial accounts with Credit Unions where the first chunk of their money, whether it be a thousand or two thousand dollars, gets a really really high interest rate,” said Plechner.

Start looking into a savings account. Savings accounts are crucial when it comes to managing one’s money. One savings account that is necessary for recessions is an emergency savings account. Typically, an emergency fund usually has at least 2-6 months worth of expenses. Emergency funds cover any unexpected events in one’s life, including a recession.

Many experts are expecting a recession to hit in late 2023 or early 2024, so learning now how to handle it is extremely important. Additionally, starting to prepare sooner will normally yield better results.🔳